Unlock the Power of Homeownership: 10 Reasons Why Buying a Home is a Smart Investment

Buying a home is one of the most significant financial decisions that many people make in their lifetime. While it can be a daunting task, the benefits of homeownership far outweigh the challenges.

Here are 10 reasons why buying a home can be a smart investment for building equity:

-

Forced savings: Every time you make a mortgage payment, you are building equity in your home. This is known as forced savings, as the money you put towards your mortgage payment is going towards something tangible, rather than disappearing into unnecessary purchases.

When you own a home, you are more likely to save money because of the concept of forced savings. Every time you make a mortgage payment, you are building equity in your home. This is known as forced savings, as the money you put towards your mortgage payment is going towards something tangible, rather than disappearing into a savings account.

Forced savings means that you are putting money towards an investment that has the potential to appreciate in value, unlike renting where the money you pay is gone and doesn't come back. This sense of ownership and investment can make you more mindful of your spending habits and encourage you to be more conscious of your finances.

Additionally, when you own a home, you have to budget for home maintenance and repairs. You will have to set aside money for things like home repairs, property taxes, and insurance. This can be a bit of a hassle, but it also makes you more conscious of your finances.

-

Appreciation:

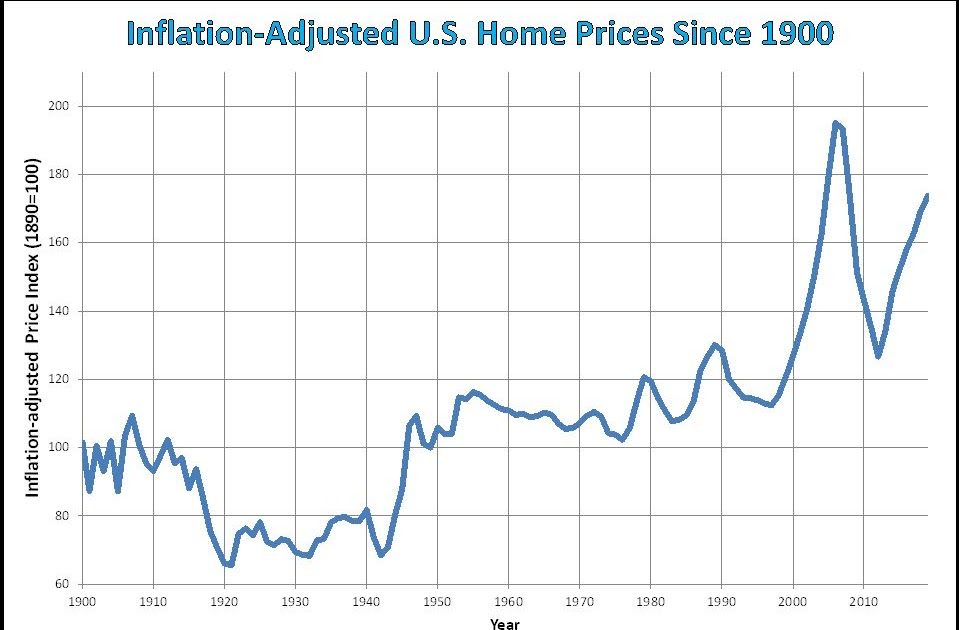

Historically, home values have appreciated over time, with the average home appreciation rate being around 4% per year according to the National Association of Realtors (NAR). However, this rate can vary depending on the location, economic conditions, and other factors.

According to data from the Federal Housing Finance Agency (FHFA), the average appreciation rate for homes between the years of 1991 and 2020 is around 3.6%.

Additionally, according to the National Association of Realtors, from 1968 to 2018, the median existing-home price for all housing types increased at an average annual rate of 4.9%.

It's also worth noting that appreciation rates can vary depending on the location. For example, the appreciation rate in some markets may be higher or lower than the national average. It's important to research the specific market you are interested in and to consult with a real estate professional to get a better understanding of appreciation trends in your area.

It's important to note that past performance is not an indicator of future results, and one should also consider other factors such as location, economic conditions, and the state of the housing market when evaluating the potential return on a real estate investment.

-

Tax benefits:

Owning a home in Texas comes with a variety of tax benefits that can help make homeownership more affordable. Here are a few examples of the tax benefits offered by the government for homeowners in Texas:

-

Homestead exemption: Texas homeowners can qualify for a homestead exemption, which can lower the amount of property taxes they have to pay. Depending on the county, homeowners may be able to save up to $25,000 on their property taxes.

-

Mortgage interest deduction: Texas homeowners who itemize their deductions on their federal income tax return can deduct the interest they pay on their mortgage. This can lower their overall tax bill and make homeownership more affordable.

-

Property tax deduction: Texas homeowners can also deduct the amount of property taxes they pay on their federal income tax return. This can also lower their overall tax bill and make homeownership more affordable.

-

Capital gains exclusion: Texas homeowners who sell their primary residence can exclude up to $250,000 ($500,000 if married) of capital gains from the sale of their home, as long as they have lived in the home for at least two of the last five years before the sale.

-

Energy efficient home improvement deductions: Texas homeowners who make energy-efficient home improvements can also qualify for tax deductions on their federal income tax return. This can include adding insulation, new windows, and solar panels.

These are just a few examples of the tax benefits offered by the government for homeowners in Texas, and it's worth noting that the tax laws are subject to change and it's always best to consult with a tax professional to understand the specific tax benefits for which you are eligible. Being a homeowner in Texas can offer a lot of financial benefits, it's a smart decision for those who are looking for stability, appreciation, and long-term savings on taxes.

-

-

Stability: Renting a home can be unpredictable, with landlords raising rent or selling the property. Buying a home gives you the stability of knowing that your housing costs will remain consistent over the long term.

According to the National Multifamily Housing Council, the national average annual rent increase was 3.2% between 2000 and 2019. It is important to note that rent increases can vary depending on location and economic conditions.

For example, according to Zillow, the median rent in the United States increased by 2.3% from 2019 to 2020, and in 2020, the median rent was $1,471. In the same period, the median rent in San Francisco, California was $4,600, an increase of 2.5% from the previous year.

Rent increases can add up over time, making it more expensive to rent over the long-term. In some cases, renters may find that they are paying more in rent over time than they would if they were making mortgage payments on a home.

For example, if a person rents a home for $1,200 per month for 30 years, they will have paid $432,000 in rent. However, if they were to purchase a home for $250,000 with a 30-year fixed-rate mortgage at 3.5% interest, their monthly mortgage payments would be approximately $1,107 per month. Over the course of 30 years, their total mortgage payments would be approximately $396,720, unlike the landlords property, this is your investment that can now be passed down for generations to come and when the time is right sell for a profit.

Sources:

- National Multifamily Housing Council: https://www.nmhc.org/research-insight/nmhc-data-points/rent-growth-over-the-last-decade/

- Zillow: https://www.zillow.com/rental-manager/resources/rent-trends-data/

It's important to note that these numbers are for reference only and it's always best to consult with a financial advisor or a real estate professional to understand the specific costs of renting or buying a home in a specific location and to get a better understanding of the current market conditions.

-

Forced maintenance keeps handyman away: When you own a home, you are responsible for its maintenance and upkeep. This can be an inconvenience at times, but it also forces you to take care of the property, which can increase its value over time. When buying a home you want to erasure you are keeping up with the property, this will help you benefit to the fullest potential when and if you decide to sell.

-

Building wealth: Homeownership is one of the most common ways that people build wealth. As you build equity in your home, you can borrow against it to make other investments or start a business. Homeownership is not just about having a roof over your head, it's about building equity. When you make a mortgage payment, you are not just paying for the privilege of living in a house, you are building equity in that property. Every payment you make towards your mortgage is money that you are investing in your future. Over time, as you pay down your mortgage and the value of your property appreciates, you are building a nest egg that you can borrow against. This is the true power of homeownership. It allows you to turn a liability into an asset. By making smart financial decisions and investing in your property, you are building a foundation for your financial future. With the equity you build in your home, you can borrow against it to make other investments or start a business. The equity you build in your home is an investment in your future and one of the most powerful ways to build wealth.

7. Sense of community: Owning a home in a neighborhood can give you a sense of belonging and community. It can also be a great way to build relationships with your neighbors and become more involved in your local community. When you own a home, you're not just buying a physical structure, you're buying into a community. There's something special about having a stake in the neighborhood you live in. When you own a home, you're invested in the community and you have a sense of belonging. You care about what's happening in your neighborhood and you want to see it thrive. Owning a home gives you a sense of pride in where you live. You feel like you have a place in the community and that you're part of something bigger than yourself. It's a great feeling to know that you're making a difference in the community and that you're helping to shape the neighborhood for future generations. Furthermore, it's a great way to build relationships with your neighbors and become more involved in your local community. Whether it's through community events, volunteering, or simply chatting with neighbors over the fence, owning a home is a great way to connect with the people around you and make a positive impact on your community.

8. Increased privacy:

Owning a home can provide more privacy than renting one. When you own a home, you have the freedom to decorate and personalize your living space to your taste. You can paint the walls, install new flooring, and make other changes to make the house truly feel like your own. You don’t have to worry about a landlord's rules or restrictions on what you can do with the property.

Additionally, when you own a home, you have more control over who comes in and out of your property. You don’t have to worry about landlords or other renters coming in and out of your home without your permission. You are also able to control who enters your property and when, giving you more security and privacy.

Furthermore, owning a home can also offer a sense of permanence, unlike renting where you have to move out when your lease expires, owning a home can provide you with a sense of stability and a long-term living situation.

In summary, owning a home can provide more privacy and control over one's living space than renting. It also allows you to personalize your home and make it truly feel like your own.

9. Forced discipline: Owning a home is a long-term commitment that requires discipline. This can be a good thing, as it forces you to budget for expenses, make smart financial decisions, and plan for the future. When you own a home, you have to make mortgage payments every month. This is a form of forced savings, as the money you put towards your mortgage payment is going towards something tangible, rather than disappearing into a savings account. This helps you be more conscious of your finances, and you are more likely to save money.

10. Building memories: Owning a home is a great way to build memories with your family. You can make your home a reflection of your personality, and your children will have a place to call home as they grow up.

There are many resources available to guide you through the home buying process. Here are a few tools that can help you make a more informed decision:

-

A mortgage calculator: This tool can help you estimate how much you can afford to spend on a home and what your monthly mortgage payments will be. https://investwithalexa.com/mortgage-calculator-1

-

A home affordability calculator: This tool can help you determine how much home you can afford based on your income, debts, and other factors.

-

A real estate agent: A real estate agent can help you find the right home for you, as well as guide you through the buying process.https://linktr.ee/alexapenarealtor

In conclusion, buying a home can provide a sense of stability and security, a way to build wealth, and a place to call your own. The benefits of homeownership far outweigh the challenges and it is a smart option to invest in real estate. With the right resources and planning, buying a home can be a positive and rewarding experience.

Recent Posts

GET MORE INFORMATION